What is JIPF?

- Japan Investor Protection Fund ("JIPF") was established on December 1, 1998, as a nonprofit membership corporation under the Financial Instruments and Exchange Act.

- JIPF will provide investor protection by paying up to 10 million yen in compensation to each customer in the event that a securities firm is unable to return the customer's cash or securities due to a problem with the separation of customers’ assets, either because of bankruptcy or other financial difficulties.

- While JIPF is administered and managed as a private organization supported by member securities firms’ membership fees and levies, it is a corporation authorized by the prime minister and the minister of finance in accordance with the Financial Instruments and Exchange Act, regulated and supervised by the Financial Services Agency and the Ministry of Finance.

- * For legal purposes, please refer to the Japanese official text.

Separate management system

- Securities firms ensure the protection of customer assets by managing them separately.

-

- Securities firms are required by law to manage the cash, shares, bonds, and other securities entrusted by customers strictly separately from their own assets. This is called the separate management of customer assets.

- As long as separate management is strictly observed, even if a securities firm goes bankrupt, this will in principle have no effect on customer assets and customers can request return of their cash and securities from the bankrupt securities firm.

- Assets which customers entrust to securities firms are protected by the dual systems of this separate management system and the compensation by JIPF, if necessary.

JIPF mission

- JIPF's mission is to protect investors and thereby maintain confidence in securities transactions.

- JIPF's mission is to protect investors and maintain confidence in securities transactions by providing compensation to general customers who seek the return of assets deposited with a securities firm in the event that the return of customer assets is deemed difficult due to the failure of the member securities firm.

Authorities of JIPF

- JIPF has two main authorities.

- First, JIPF has the authority to pay compensation after recognizing the necessity of compensation and issuing public notice in cases where a securities firm cannot return the cash and securities of customers because of bankruptcy or other financial difficulties.

- Second, JIPF has the authority to manage an investor protection fund that can be used to provide compensation.

- The Financial Instruments and Exchange Act and other laws stipulate JIPF’s other powers, which are generally exercised (a) after receiving approval from the Financial Services Agency and the Ministry of Finance, (b) with the consent of the customers of members, (c) under prior consignment from member securities firms, or (d) by appointment or nomination to a particular position based on the provision of the Bankruptcy Act, the Deposit Insurance Act, and other laws. These authorities are not exercised independently by JIPF.

- As for the powers which JIPF can exercise independently aside from the two main authorities stated above, JIPF may, when deemed necessary, demand that members submit reports and materials regarding the state of their business or property which serve as a reference, or have JIPF staff audit members firms.

Scope of compensation

Customers eligible for compensation

Of the customers of JIPF member securities firms, those entitled to receive compensation from JIPF are general customers who are not "professional investors" that include financial institutions and other qualified institutional investors, as well as national and local governments.

Customers who would otherwise be eligible for compensation are excluded from compensation in the event of trading their assets in the name of others, using fictitious names or borrowed names.

The executives of bankrupt securities firms as well as their parent companies, among others, are also excluded from compensation.

Transactions eligible for compensation

The cash, securities, and other customer assets eligible for compensation are limited to those entrusted by customers concerning the securities-related business or the commodity derivatives-related business conducted by securities firms.

- The transactions eligible for compensation by JIPF include the following:

- Share transactions (including shares issued overseas)

- Public and corporate bonds transactions (including those bonds issued overseas)

- Investment trust transactions (including those trusts issued overseas)

- Deposits concerning margin transactions of shares

Note: The items eligible for compensation are margin deposits and securities deposited in lieu of margin deposits

- Clearing margins concerning securities futures transactions and securities options transactions on domestic exchanges

Example: Clearing margins and securities deposited in lieu of clearing margins for Nikkei 225 futures or Nikkei 225 options transactions on the Osaka Exchange

- Clearing margins concerning equity index margin transactions on domestic exchanges

Example: Clearing margins and securities deposited in lieu of clearing margins concerning exchange equity index margin contracts on the Tokyo Financial Exchange

- Of transactions handled by securities firms, those NOT eligible for compensation by JIPF include the following:

- Over-the-counter securities derivatives transactions (securities futures, options, and contract-for-difference [CFD] transactions that are conducted directly between the parties outside of exchange markets)

- Market securities derivatives transactions on overseas exchanges (securities futures, options, and CFD transactions conducted on overseas exchanges)

- On-exchange currency transactions (Click 365 transactions on the Tokyo Financial Exchange, etc.)

- Foreign exchange margin transactions (FX transactions)

- Transactions of financial instruments that fall under the Type II Financial Instruments Business, such as trust beneficial rights, or rights in partnership agreements, anonymous partnership agreements or investment limited partnership agreements.

- These transactions are excluded from compensation by JIPF, either in accordance with the provisions of the Financial Instruments and Exchange Act, presumably for the reason that almost all the customers conducting these transactions are professional investors.

- Shares and corporate bonds issued by a bankrupt securities firm are excluded from compensation, even where these transactions would otherwise be eligible for compensation.

Compensation procedure

- The steps of the compensation procedure are as follows:

-

- (1) JIPF’s member securities firms must immediately notify JIPF in the event that their registration is revoked or that they file a petition for the commencement of bankruptcy proceedings (hereinafter, such member securities firms are referred to as "Notifying Members").

- (2) JIPF conducts an audit to confirm whether the Notifying Member holds customers' cash and securities by managing them separately from its own assets.

- If the court issues a provisional administration order, the disposition of the property of the Notifying Member is prohibited and a provisional administrator is appointed.

- JIPF receives a report from the provisional administrator regarding changes in the customer assets entrusted to the Notifying Member.

- (3) In cases where the Notifying Member is unable, or highly likely to be unable, to return the cash and securities entrusted by customers, JIPF determines to grant recognition, and issue public notice, of the member's difficulty in fulfilling obligations to customers.

- Customers submit documents to JIPF requesting payment in accordance with the period, location, method, and other particulars for requesting compensation stated in newspaper public notices or notices mailed to customers or JIPF's website.

- (4) JIPF checks customer documents requesting payment against the records of the Notifying Member, determines the amount to be paid by JIPF, and pays compensation.

- Customers' cash is calculated based on its ledgers and other documents.

- The value of customer's securities is determined at the closing price on the market on the day the public notice was made.

- The amount of compensation to be paid by JIPF also considers the amount obtained by deducting the customer's debt to the member and collateral provided.

- JIPF pays compensation up to ¥10 million per customer. JIPF acquires the claim which was the subject of the compensation from the customer.

- (5) The bankruptcy trustee initiates the liquidation proceedings of the Notifying Member in parallel with JIPF's compensation payment determination process.

- Customers requesting payments exceeding ¥10 million may be entitled to receive additional distributions.

- JIPF confirms the status of customer assets with the bankruptcy trustee, prepares a list of customers requesting payments exceeding ¥10 million, and submits this to the court.

Fund for investor protection ("Investor Protection Fund")

Balance of Investor Protection Fund

The balance of the Investor Protection Fund of JIPF was approximately ¥58.4 billion at the end of fiscal 2024.

Investment of Investor Protection Fund

The Investor Protection Fund can be invested only in the government bonds, bank deposits, and other instruments in accordance with the rules set by the prime minister and the minister of finance.

Collection of levies for Investor Protection Fund

The amount deemed sufficient as necessary for investor protection activities is ¥50.0 billion under the provisions of the approved business rulebook.

When the balance of the Investor Protection Fund is less than ¥50.0 billion, member securities firms must pay the levies computed based on the prescribed basic amount of ¥5.0 billion per year.

Because the balance of the Investor Protection Fund has been exceeding ¥50.0 billion, JIPF has not collected any levies since fiscal 2003.

When levies are collected, the levies are composed of a fixed amount and a variable amount for each member firm.

The basic amount is set at ¥5.0 billion per year as prescribed in the business rulebook.

The levies of each member are the total of the following (A), (B), and (C):

- The amount derived by dividing a sum equal to 20% of the prescribed basic amount by the number of members (A);

- The amount derived by multiplying a sum equal to 40% of the basic amount by the ratio of each member’s operating revenue to the total operating revenue of all members (B); and

- The amount derived by multiplying a sum equal to 40% of the basic amount by the ratio that is obtained by dividing the amount of customer assets eligible for compensation of each member by the total amount of the customer assets eligible for compensation of all members (C).

History

| 1968 | Entrusted Securities Compensation Fund was established by the securities industry as a precursor of JIPF. |

| 1969 | Entrusted Securities Compensation Fund becomes an incorporated foundation. |

| 1998 | Entrusted Securities Compensation Fund reorganized into Japan Investor Protection Fund (JIPF) under the revised Securities and Exchange Act. At the same time, a separate entity, Securities Investor Protection Fund was established, mostly by foreign securities companies as its main members. |

| 2002 | JIPF and Securities Investor Protection Fund merged to become the present JIPF. |

| 2007 | The Securities and Exchange Act, revised into the Financial Instruments and Exchange Act, was put into force, under government's policies focusing on embracing the diversification, fairness, and transparency of financial instruments and services. |

| 2010 | An informal international forum for investor protection funds in various jurisdictions was formed, and the forum has been held almost every year since then. |

| 2018 and 2019 | In order to promote international cooperation among the investor protection fund systems, JIPF concluded MOUs with SIPC in the United States (2018) and CIPF in Canada (2019). |

Background to the establishment of JIPF

The so-called economic bubble busted in the early 1990s, followed by difficult conditions in the Japanese economy with the bad debt problem, corporate bankruptcies, and long-term recession.

By 1998, two leading securities firms and three large financial institutions failed in Japan. The government revised regulations that had contributed to inefficiencies at banks, insurance companies, and securities firms, and advanced reforms toward "free, fair, and global markets" in the so-called "Financial Big Bang" from 1997 to around 2001.

In the securities field, a registration system, instead of licensing system, was introduced to promote the entry of new firms, and the liberalization of the securities business was initiated. These measures, however, were also expected to increase the possibility of securities firm closures and failures due to heightened competition, among other factors. From the perspective of preventing unexpected customer damages, securities firms were therefore legally obliged to comply with separation rules. By strictly segregating assets entrusted by customers from firms' own assets, securities firms ensure the smooth and secure return of customer assets, in the event that they are unable to conduct business due to bankruptcy or other reasons. In the event that such a violation of the obligation to maintain separate management were to occur, JIPF was established to serve as a safety net to supplement the separation rule.

Organization

Members

- All securities firms are obliged to become members of JIPF.

- The members of JIPF (securities firms) are defined under the Financial Instruments and Exchange Act as follows:

- Entities eligible for membership in JIPF are limited to the Type I Financial Instruments Business Operators conducting securities-related business or commodity derivatives transaction-related business.

Members

Officers

- JIPF‘s officers include the chairman, two or more directors, and one or more auditors.

- These officers are appointed by resolution of General Meeting of members from among the Member Representative and individuals who have expertise and experience necessary for the proper operation of JIPF.

Member List of Board of Directors (As of July 1, 2025)

| Chairman | OKUBO Yoshio |

| Director | UEMURA Tatsuo

(Waseda University) |

| Director | KUSUNOKI Yuji

(Rakuten Securities, Inc.) |

| Director | SHIMAMOTO Koji

(Societe Generale Securities Japan Limited) |

| Director | SHINSHIBA Hiroyuki

(Okasan Securities Co., Ltd.) |

| Director | TAKENO Mario

(Japan Securities Dealers Association) |

| Director | HARADA Kimie

(Chuo University) |

| Director | HIDA Kenichi

(SMBC Nikko Securities Inc.) |

| Director | FUJISAWA Kumi

(Institute for International Socio-Economic Studies, Ltd.) |

| Director | MIZUNO Shinichi

(Nomura Securities Co., Ltd.) |

| Auditor | ARAKAWA Shinji

(Certified Public Accountant) |

| Auditor | KOBAYASHI Masahiro

(Meiwa Securities Co., Ltd.) |

| Senior Managing Director | SAKAI Tatsuhiro |

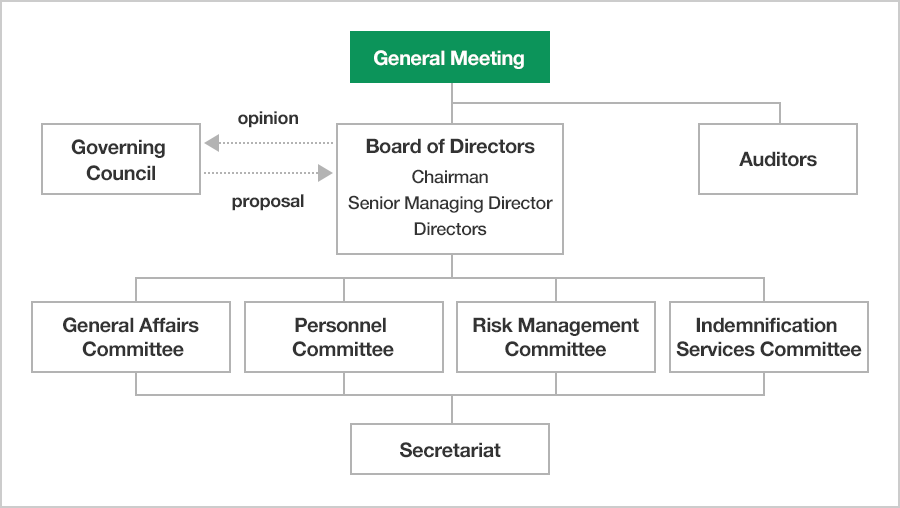

General Meeting

- The General Meeting is the highest body that makes the decisions of JIPF.

- JIPF is required to report resolutions passed by the General Meeting to the prime minister and the minister of finance.

Board of Directors

- Board of Directors adopts resolutions regarding matters prescribed in the ARTICLES OF INCORPORATION and important matters for the operation of JIPF.

- The Board of Directors is composed of the chairman and of at least two and no more than 12 directors

Governing Council

- The Governing Council is tasked with determing of difficulty in payment to customers in cases where a Notifying Member is unable, or highly likely to be unable, to return the money and securities entrusted by customers, and with making proposals to the chairman regarding the appropriate operation of JIPF.

- The Governing Council is composed of up to eight members.

Compensation record

- Since it was established on December 1, 1998, JIPF has paid compensation to customers in the following two cases:

-

- Minami Securities Co., Ltd. (head office: Gunma Prefecture) with a total compensation amount of approx. ¥3.5 billion* (fiscal 2000)

(*There was no ¥10 million compensation limit at that time); and

- Marudai Securities Co., Ltd. (head office: Tokyo) with a total compensation amount of approx. ¥172 million (fiscal 2012).

Additionally, JIPF's predecessor, the voluntary association, Entrusted Securities Compensation Fund, had paid compensation to customers, which had all been completed. The association's entire assets and liabilities were taken over by JIPF.

Number of members and fund scale

Number of members (as of March 31 of each fiscal year)

| 2021 | 2022 | 2023 | 2024 | 2025 |

| 265 | 268 | 268 | 265 | 261 |

Fund scale (in million yen, as of March 31 of each fiscal year)

| 2021 | 2022 | 2023 | 2024 | 2025 |

| 58,392 | 58,420 | 58,436 | 58,448 | 58,457 |

Information on international relations, etc.

Study Group on Securities Firm Bankruptcy Laws and on Investor Protection Fund Systems

Cooperative research with Japan Securities Research Institute

1. Themes

- First meeting May 21, 2014

- "Japan Investor Protection Fund: Current Conditions and Issues"

- Second meeting July 16, 2014

- "US Investor Protection Fund System: Legal System and Issues concerning Securities Firm Bankruptcy"

- Third meeting October 22, 2014

- "Investor Protection Mechanism in Germany"

- Fourth meeting December 10, 2014

- "Investor Protection Fund System in the UK"

- Fifth meeting March 4, 2015

- "Investor Protection Fund System in France"

- Sixth meeting April 22, 2015

- "EU Investor Compensation Schemes in Case of Securities Firm Bankruptcies"

- "Examinations of Draft Question Items for Overseas Field Studies"

- Seventh meeting June 24, 2015

- "Canada's Investor Protection System in Case of Bankruptcies of Securities and Other Firms"

- "Return of Customer Assets at Time of Securities Firm Bankruptcies, Etc.: Current Problems in Japan"

- "Question Items and Other Matters for Field Study in the UK"

- Eighth meeting September 30, 2015

- "Report of Field Study in the UK"

- "Question Items and Other Matters for Field Study in France"

- Ninth meeting February 10, 2016

- "Field Study in France and Pre-answer to the Question"

- "Recent situation of US Investor Protection Fund System"

- Tenth meeting April 27, 2016

- "Report of Field Study in France"

- "Question Items and Other Matters for Field Study in Germany"

- Eleventh meeting July 27, 2016

- "Report of Field Study in Germany"

- "Ireland's Investor Compensation schemes ~relationship with EU directive~"

- Twelfth meeting November 16, 2016

- "Survey report of Germany"

- Thirteenth meeting March 22, 2017

- "Survey report of UK, France and Germany"

- Fourteenth meeting June 28, 2017

- "Question Items and Other Matters for Field Study in US"

- "Schedule for Field Study in US"

- Fifteenth meeting October 18, 2017

- "Report of Field Study in US"

- "The FSA’s Approach to Introduce the TLAC Framework"

- Sixteenth meeting November 29, 2017

- "Report of Investor Protection Fund System in US"

- "Issues on Investor Protection Fund System"

- Seventeenth meeting January 31, 2018

- "Legal System and Issues Concerning Resolution and Compensation for Securities Firms"

- "International Trends in Legal System for Bankruptcy of Securities Firms after Lehman Shock"

- "Practical Issues and Future Challenges on Japan Investor Protection Fund"

- Eighteenth meeting April 11, 2018

- "Free Discussion based on the Report of the Previous Meeting"

- Nineteenth meeting November 2, 2018

- "Investor Protection System in the US"

- Twentieth meeting May 9, 2019

- "Overview of Canadian Investor Protection Fund and its Role in the Canadian Financial System"

- Twenty-first meeting August 1, 2019

- Summary of "Overseas Field Study Report on Investor Protection Fund System"

2. Overseas field studies

- (1) Scheduled for fiscal 2015

- UK (August 2015)

- France (January 2016)

- (2) Scheduled for fiscal 2016

- (3) Scheduled for fiscal 2017

- US (August to September 2017)

International conferences

International Compensation Fund Meeting

- (1) International Compensation Fund Meeting

Date: June 9, 2010

Location: Montreal, CANADA

- (2) International Compensation Fund Meeting

Date: April 19, 2011

Location: Cape Town, SOUTH AFRICA

- (3) International Compensation Fund Meeting

Date: May 15, 2012

Location: Beijing, CHINA

- (4) International Compensation Schemes Meeting

Date: September 21, 2013

Location: Rome, ITALY

- (5) International Securities Investor Protection Conference

Date: May 15-16, 2014

Location: Shanghai, CHINA

- (6) International Seminar- Investor Compensation Schemes

Date: June 19, 2015

Location: London, UK

- (7) International Investor Compensation Fund Meeting

Date: September 29, 2016

Location: Vilnius, LITHUANIA

- (8) International Securities Investor Protection Conference

Date: August 30-31, 2017

Location: Beijing, CHINA

- (9) International Meeting of Investor Protection Funds

Date: May 9, 2018

Location: Budapest, HUNGARY

- (10) International Meeting of Investor Protection Funds

Date: May 15, 2019

Location: Sydney, AUSTRALIA

- (11) Forum of International Investor Compensation Schemes

Date: May 26, 2023

Location: Budapest, HUNGARY

- (12) International Investor Compensation Schemes Conference

Date: May 28, 2024

Location: Nice, FRANCE

- (13) Investor Compensation Schemes International Conference

Date: June 3, 2025

Location: Madrid, SPAIN

Procedure for Joining JIPF

The following shows the procedures to join the JIPF as a TypeI Financial Instruments Business Operator engaged in the securities-related business and/or commodity derivatives transaction-related business:

Step 1: Preliminary Consultation

- Prepare in advance the draft application documents that are to be submitted on the day of application.

Step 2: Submission of Application for Admission (Date of Application for Admission = Date of Application for Registration)

- The date of application for admission must be identical to the date of application for registration to the administrative authority.

Step 3: Membership Examination, etc.

- In principle, the membership examination is carried out through interviews to be held at the Administrative Office of the JIPF. Please have the representative (a must) and an officer(s), who can explain the business activities of the firm and application documents, and attend the interview.

- The Risk Management Committee will be held to deliberate on the membership applications.

Step 4: Determination of Admission (Date of Admission = Date of Registration)

- Upon approval at the Committee above, the procedure at the JIPF is completed.

- The date of admission must be identical to the date of registration to the authority.

- On the day of registration, it is required to submit the Registration Report to the JIPF by email.

- The JIPF will then mail the new member the Notice of Admission, Bill for Levies, and other relevant documents.

Admission fee, Levies, and Membership Fee

When joining the JIPF as a securities firm, the applicant firm will be required to pay the admission fee, levies, and membership fee.

*Details will be informed in the application process.

- Pay the levies and other fees described above within one week from the date of admission (*due date is negotiable in advance if necessary).

- Once the new firm starts operations, submit the Business Commencement Report to the JIPF by email.

This completes the procedure for admission.

Support Desk in English

Foreign securities companies can apply for the admission process in English instead of Japanese.

Please contact us at the following link.

ARTICLES OF INCORPORATION and REGULATIONS OF BUSINESS