-

What does "investor protection" mean under the Investor Protection Fund System?

What does "investor protection" mean under the Investor Protection Fund System?

-

- Securities firms are obliged to manage customer assets entrusted by customers separately from the firm’s own assets. The purpose of this obligation is to return customer assets deposited with the securities firm to the rightful owner, the customer, even if the securities firm goes bankrupt. However, it is possible that customer assets may not be fully returned for some reason, such as inappropriate separation or the failure of a securities firm before the necessary procedures have been completed, including required settlement.

- Japan Investor Protection Fund (JIPF) provides compensation within a defined limit (up to 10 million yen per customer) for any cash or securities that are not returned to customers in the event of the insolvency of a member securities firm. This is the meaning of “investor protection” under the Investor Protection Fund System in Japan.

- Therefore, JIPF does not cover damages or losses that are not related to the separate management system, such as losses caused by market price declines, nonpayment of principal and interest due to the insolvency of an issuer, or damages caused by a securities firm’s breach of its duty of explanation.

-

What happens to my securities and cash if my securities firm goes bankrupt?

What happens to my securities and cash if my securities firm goes bankrupt?

-

- Securities firms are required by law to strictly divide and manage the cash, shares, bonds, investment trusts, and other securities entrusted by customers separate from the cash, securities, and other assets that belong to the securities firm itself. This is called the "separate management" of customer assets.

- With the proper execution of separate management, even if a securities firm goes bankrupt, this will have no effect on customer assets in principle, and customers can have their own cash and securities returned from the bankrupt securities firm.

(Even if a customer has deposited more than 10 million yen in assets with a securities firm, as long as the segregation of assets is properly managed, the assets can be returned to the customer.)

- Regardless, in the unlikely event that a bankrupt securities firm cannot smoothly return customer assets for some reason, JIPF pays compensation for unreturned cash and securities up to ¥10 million in total of cash and securities (market value) per customer.

- In this way, the assets which customers entrust to securities firms are protected by the dual systems of separate management and the investment protection fund system.

- For details regarding the separate management system, see the Japan Securities Dealers Association web page: https://www.jsda.or.jp/anshin/bunbetsu/index.html [in Japanese]

-

Is my securities firm a JIPF member?

Is my securities firm a JIPF member?

-

Please refer to

the members' list to confirm that your securities firm is a JIPF member.

-

Are investment trusts that I purchase at a bank or other financial institution that is not a securities firm covered by JIPF?

Are investment trusts that I purchase at a bank or other financial institution that is not a securities firm covered by JIPF?

-

Banks and other financial institutions are not securities firms, and are not JIPF members. Consequently, investment trusts purchased at banks are not covered by JIPF. (Nevertheless, separate management is required by law even for investment trusts purchased at banks and other financial institutions).

-

Are all cash and securities entrusted to securities firms eligible for compensation by JIPF?

Are all cash and securities entrusted to securities firms eligible for compensation by JIPF?

-

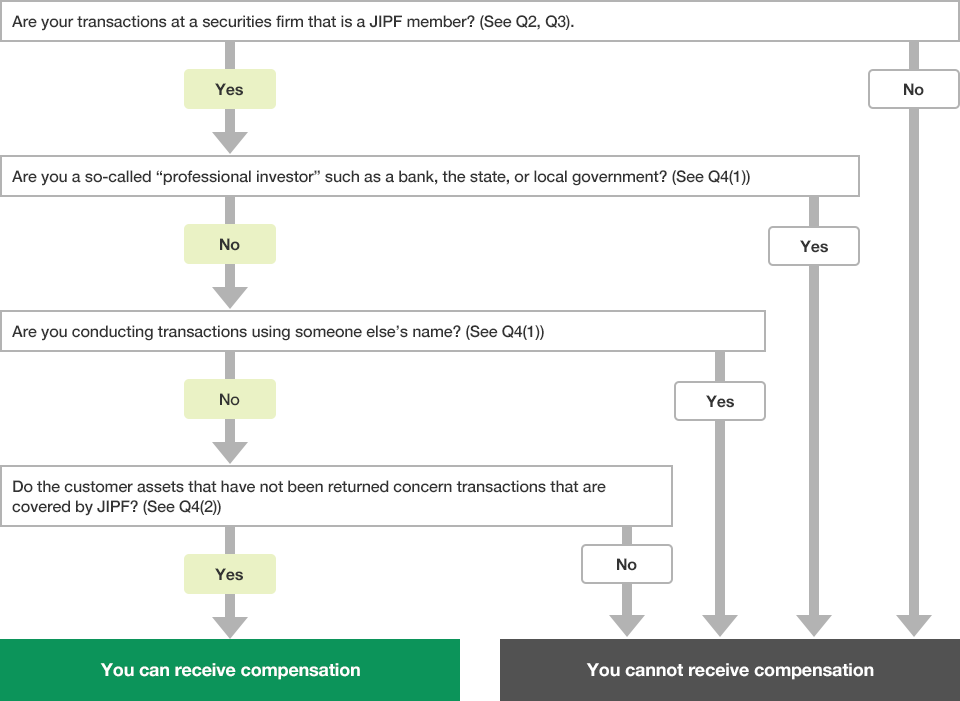

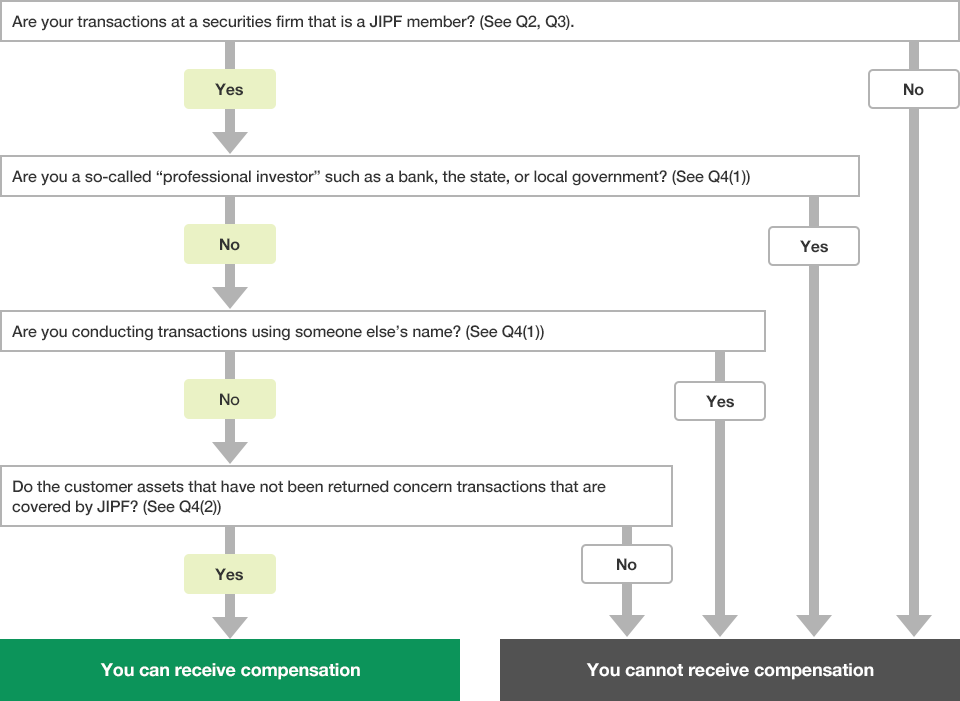

Please note that there are cases where cash and securities are not covered by JIPF, even though they are entrusted to securities firms, depending on the customer attributes and transaction contents.

-

(1) Customers Eligible for Compensation

The customers covered by JIPF are those customers of JIPF member securities firms who are not so-called "professional investors" such as financial institutions, the national and local governments. (In the statutes, these customers who are covered are referred to as "General Customers").

*) Even for General Customers, assets of customers executing transactions in the name of others are excluded from the range of compensation . Also, executives of the bankrupt security firm are not included among the customers eligible for compensation.

-

(2) Transactions Eligible for Compensation

The cash, securities, and other customer assets eligible for compensation are limited to those entrusted to Type I Financial Instruments Business transactions conducted by securities firms regarding securities-related business or the transaction related to commodity derivatives transaction-related business. Even among transactions conducted by the same securities firm, customer assets related to foreign exchange margin transactions (FX transactions), cryptoassets transactions and other transactions that are not included in the securities-related business or commodity derivatives transaction-related business are not covered by JIPF.

*) Among transactions eligible for compensation, shares, corporate bonds and other securities, that are issued by the bankrupt securities firm are excluded from the range of compensation. (See Q7).

- The main transactions covered by JIPF are as follows.

- Share transactions (including shares issued overseas)

- Public and corporate bond transactions (including bonds issued overseas)

- Investment trust transactions (including investment trusts issued overseas)

- Deposits concerning margin transactions of shares

(Note) The items for which compensation can be made are security deposits and securities in lieu of security deposits.

- Clearing margins concerning exchanged-listed market derivatives transactions (limited to securities-related derivatives transactions and commodity-related derivatives transactions) on domestic exchanges

(Examples) Clearing margins and collateral securities in place of clearing margins for Nikkei 225 futures transactions, Nikkei 225 options transactions or Gold Standard Futures on the Osaka Exchange

- Clearing margins concerning margin transactions of stock price indices on domestic exchanges

(Examples) Clearing margins and collateral securities in place of clearing margins concerning exchange equity index margin contracts on the Tokyo Financial Exchange

- Among transactions handled by securities firms, the transactions NOT covered by JIPF include the following.

- Over-the-counter derivatives transactions (futures, options, and CFD [contract for difference] transactions negotiated outside of exchange markets).

- Securities market derivatives transactions on overseas exchanges (securities futures, options, and securities CFD transactions on overseas exchanges)

- Currency-related transactions on exchanges (exchange foreign margin contracts on the Tokyo Financial Exchange, etc.)

- Foreign exchange margin transactions (FX transactions)

- Transactions of financial instruments that fall under the Type II Financial Instruments Business such as collective investments

-

How can I judge whether I can receive compensation from JIPF?

How can I judge whether I can receive compensation from JIPF?

-

Are valuation losses on purchased securities and losses from the default of the securities issuer covered by JIPF?

Are valuation losses on purchased securities and losses from the default of the securities issuer covered by JIPF?

-

- JIPF compensation only covers losses of cash and securities that are required to be separately managed by law in cases where they cannot be returned to customers when a securities firm goes bankrupt.

- Consequently, even if the securities are lost and there is a valuation loss from the price decline of those securities that had been entrusted to a bankrupt securities firm by a customer at the time it went bankrupt, JIPF only provides compensation for the market value of the concerned securities at that time, and does not compensate for valuation losses (differences between market value and the principal invested).

- Also, JIPF does not provide compensation in cases where an issuer cannot pay the interest or repay principal of bonds due to the default of the issuer.

-

How are the amounts of compensation by JIPF calculated?

How are the amounts of compensation by JIPF calculated?

-

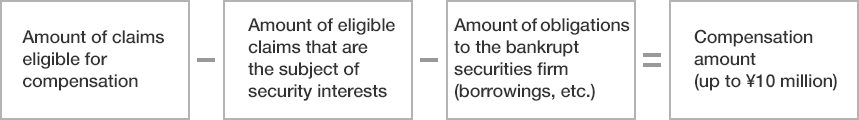

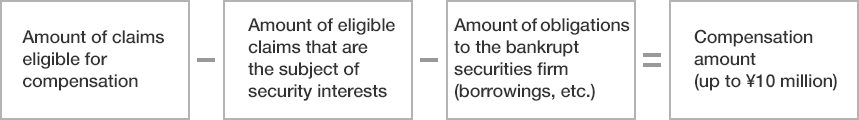

- JIPF pays monetary compensation of up to ¥10 million per person for cash and securities that could not be returned by a bankrupt securities firm.If multiple securities firms with which a customer trades fail, JIPF will provide compensation in cash up to a total of 10 million yen per person for each failed securities firm (the same applies even if multiple securities firms fail at the same time).

- Even in cases where the customer assets that could not be returned are securities, the compensation is provided in cash, not in securities. In cases where customers' securities are listed on an exchange, the compensation amount of the securities will be based on the closing price on the day JIPF made public announcements that it will provide compensation in newspapers and by other means.

- In cases where the customer has obligations to the securities firm (for example, in cases where the securities firm paid the purchase price on behalf of the customer), the amount of the concerned obligations is deducted when calculating the compensation amount.

Compensation Amount Calculation Method

-

Will my assets beyond JIPF’s compensation limits not be returned at all?

Will my assets beyond JIPF’s compensation limits not be returned at all?

-

Customers have the right to demand the return of cash and securities deposited with a bankrupt securities firm (right to claim return).

When JIPF provides compensation to customers, the right to claim a refund equivalent to the amount of compensation is transferred from the customer to JIPF as a condition of this compensation, but JIPF does not accept the transfer of the right to claim a refund for amounts exceeding the scope of JIPF’s compensation, so the customer will continue to hold this right.

If the bankrupt securities firm has gone through insolvency proceedings, the customers retains a claim for the right to receive a refund that has not been transferred to JIPF, and can receive a dividend from the remaining assets of the securities firm in accordance with the procedures (whether or not the customer can receive a dividend and at what rate it will be distributed will vary from case to case).

Please also see the section "What are the compensation procedures?", Paragraph 5 (Participation in bankruptcy proceedings).

-

What is the compensation system for over-the-counter securities derivatives transactions and foreign securities market derivatives transactions?

What is the compensation system for over-the-counter securities derivatives transactions and foreign securities market derivatives transactions?

-

All customer assets such as cash and securities related to OTC derivatives transactions and foreign securities market derivatives transactions are not covered by JIPF. (See Q5(2).

As the word "over-the-counter" implies, OTC derivatives transactions are conducted on a bilateral basis between customers and securities companies for futures, options and CFD transactions, without placing orders on an exchange on behalf of the customers. Types of transactions include futures, options and CFDs on securities, and futures, options and CFDs on commodities such as precious metals.

Here, foreign securities market derivatives transactions, not covered by JIPF, refer to transactions of securities futures, options, and securities CFD transactions not on domestic exchanges, but on overseas exchanges.

-

What is the compensation system for transactions that fall under the Type II Financial Instruments Business such as trust beneficial rights or a partnership contract, and regarding FX transactions?

What is the compensation system for transactions that fall under the Type II Financial Instruments Business such as trust beneficial rights or a partnership contract, and regarding FX transactions?

-

Transactions that fall under the Type II Financial Instruments Business such as transactions concerning trust beneficial rights or a partnership contract, and FX transactions are not covered by JIPF. (See Q5(2)).

-

What is the compensation system regarding commodity-related market derivatives transactions on the comprehensive exchange?

What is the compensation system regarding commodity-related market derivatives transactions on the comprehensive exchange?

-

Customer assets (cash, commodities, securities, warehouse receipts) regarding commodity-related market derivatives transactions on the Osaka Exchange are covered by JIPF.

However, in cases where the customer transaction counterparty is a JIPF member but also a specified member of the National Futures Protection Fund, portions pertaining to commodity-related market derivatives transactions are covered by the National Futures Protection Fund, not JIPF.

For information regarding specified members of the National Futures Protection Fund, see the National Futures Protection Fund’s web page:

http://www.hogokikin.or.jp/meibo.htm [in Japanese]

Please note that commodity derivatives transactions that are traded on the integrated exchange are eligible for compensation. OTC derivatives transactions, which are conducted between customers and brokerage firms without placing orders on an exchange, are not covered by the compensation.

-

I bought securities based on the securities firm's explanation, but I found out that the securities firm's explanation was false. In this case, will JIPF provide compensation for the loss I incurred?

I bought securities based on the securities firm's explanation, but I found out that the securities firm's explanation was false. In this case, will JIPF provide compensation for the loss I incurred?

-

No. Basically, the securities firm is liable for any losses incurred due to its misrepresentation.

Even if the securities firm goes bankrupt and cannot compensate you, JIPF will not provide compensation because the loss was not caused by inappropriate separation of customers' assets.

If the bankrupt securities firm has gone through insolvency proceedings, customers can retain a claim for damages and can receive a dividend from the residual assets(estate) of the securities firm in accordance with the proceedings (whether or not the customer can receive a dividend and at what rate it will be distributed will vary from case to case).

Please also see the section "What are the compensation procedures?", Paragraph 5 (Participation in bankruptcy proceedings).

-

Why don't you cover damage caused by securities firms' misconduct?

Why don't you cover damage caused by securities firms' misconduct?

-

Investor protection fund worldwide is an organization that provides compensation up to a certain limit in order to maintain the reliability of securities transactions in the event that a securities firm goes bankrupt and cannot return customer assets, and that it does not cover damage caused by securities firm is fraud in general. Investor protection funds in the U.S. (SIPC), Canada (CIPF), EU and other countries have been established based on the same concept as in Japan. These funds are operated with contributions from sound securities firms that participate in them, and if they were to compensate for fraud in general, securities firms with sound management would bear the burden, which could in turn even encourage fraudulent behavior by securities firms (moral hazard). Therefore, we do not provide such compensation.

SIPC:Securities Investor Protection Corporation

CIPF:Canadian Investor Protection Fund

-

Can I find out the status of separation of customer assets of a securities firm?

Can I find out the status of separation of customer assets of a securities firm?

-

-

I purchased securities at a brokerage firm, but the issuer went bankrupt. Will JIPF provide compensation in this case?

I purchased securities at a brokerage firm, but the issuer went bankrupt. Will JIPF provide compensation in this case?

-

If the securities become worthless due to the insolvency of the issuer of the securities, or if the principal and interest payments are not made due to default, JIPF will not provide compensation because the loss or damage customers have suffered is not due to the breach of segregation requirement at the securities firm. Customers' rights will be dealt with in the insolvency proceedings of the issuer.

-

Is it possible for an individual to request compensation from JIPF, if JIPF has not certified and publicly notified that it will provide compensation?

Is it possible for an individual to request compensation from JIPF, if JIPF has not certified and publicly notified that it will provide compensation?

-

If JIPF has not certified or publicly notified that it will provide compensation, customers cannot request compensation from JIPF.

The procedures for compensation by JIPF are specifically stipulated in the Financial Instruments and Exchange Act. When JIPF certifies and publicly announces that it is difficult for securities firms to return customer assets, compensation shall be paid to customers who submit a payment request within the publicly announced notification period.